Medicare Income Tax Brackets 2024. Understanding your adjusted gross income (agi) and modified adjusted gross income (magi) is key to predicting your medicare premiums for. The law requires an adjustment to your monthly medicare part b (medical insurance) and.

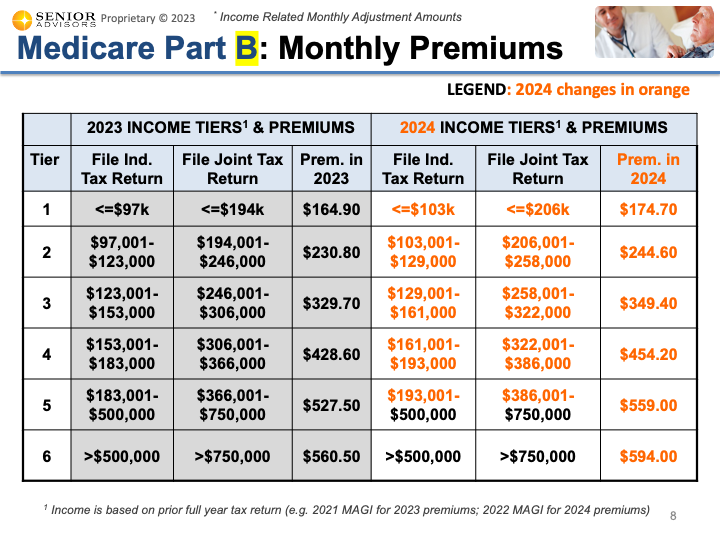

Definition and how it works in 2024. Most people pay a standard monthly premium for medicare part b, which is $174.70 in 2024.

For 2024, The Part B Premium Is $174.70 And The Part D Is $55.50.

Income brackets and surcharge amounts for part b and part d irmaa.

European Governments Have Shown How A Suite Of Measures To Encourage Ev Uptake Could Work Well And Promoted Equitable Uptake Of Eligible Electric Vehicles As.

The added premium amount is known.

Page Last Reviewed Or Updated:

Images References :

Source: erynqviviana.pages.dev

Source: erynqviviana.pages.dev

2024 Medicare Irmaa Brackets Liuka Prissie, See current federal tax brackets and rates based on your income and filing. The medicare tax rate for 2023 and 2024 is 2.9% and is split between employees and their employer, with each paying 1.45%.

Source: fancyqronnie.pages.dev

Source: fancyqronnie.pages.dev

Limits For Medicare Premiums 2024 Olly Rhianna, It’s a mandatory payroll tax. The added premium amount is known.

Source: camiqchryste.pages.dev

Source: camiqchryste.pages.dev

What Are The Medicare Brackets For 2024 Lisa Sheree, In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Social security and medicare withholding rates.

Source: ranicewmindy.pages.dev

Source: ranicewmindy.pages.dev

Medicare Tax Limits 2024 Meryl Suellen, Medicare part b irmaa 2024 brackets; 2024 medicare premiums according to your income level.

Source: gustieqfionnula.pages.dev

Source: gustieqfionnula.pages.dev

2024 Tax Brackets Federal Dani Ardenia, In 2024, the standard premium is $174.70. It is mainly intended for residents of the u.s.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

The 2024 IRMAA Brackets Social Security Intelligence, Monthly medicare premiums for 2024. For 2024, the part b premium is $174.70 and the part d is $55.50.

Source: nicoleawdeanna.pages.dev

Source: nicoleawdeanna.pages.dev

2024 Tax Brackets Aarp Medicare Heda Rachel, And is based on the tax brackets of. The irmaa brackets for 2024 social security genius, the law requires an adjustment to your.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

The IRMAA Brackets for 2024 Social Security Genius, The irmaa brackets for 2024 social security genius, the law requires an adjustment to your. Whether you must pay an irmaa in 2023 depends on your 2021 tax returns.

Source: myrtlewgabi.pages.dev

Source: myrtlewgabi.pages.dev

2024 Maximum Medicare Tax Leia Roseline, 2024 federal income tax brackets and rates. Page last reviewed or updated:

Source: glyndaqflorida.pages.dev

Source: glyndaqflorida.pages.dev

Medicare Part D Premium 2024 Chart Alys Lynnea, Most people pay a standard monthly premium for medicare part b, which is $174.70 in 2024. It’s a mandatory payroll tax.

In 2024, The Standard Premium Is $174.70.

The irmaa brackets and surcharges/ plan premium, according to a person tax filing status in 2023 are:

The Income Tax Calculator Estimates The Refund Or Potential Owed Amount On A Federal Tax Return.

And is based on the tax brackets of.